Types of cryptocurrency

Blockchain mining is the computational work that network nodes undertake to validate the information contained in blocks. So, in reality, miners are essentially getting paid for their work as auditors. https://deusexmagnifica.com/ They are conducting the first verification of Bitcoin (BTC) transactions, opening a new block, and being rewarded for their work.

Cudo Miner: This mining pool app is similar to BetterHash in that it mines multiple coins and automatically switches to the most profitable crypto for your mining rig. However, it also has a feature for internet cafe owners, where they can use vacant computer stations to mine, helping them earn profits from idle computers. Once you log on to play a game, the computing resources revert to gaming use, so you won’t experience lag in your game.

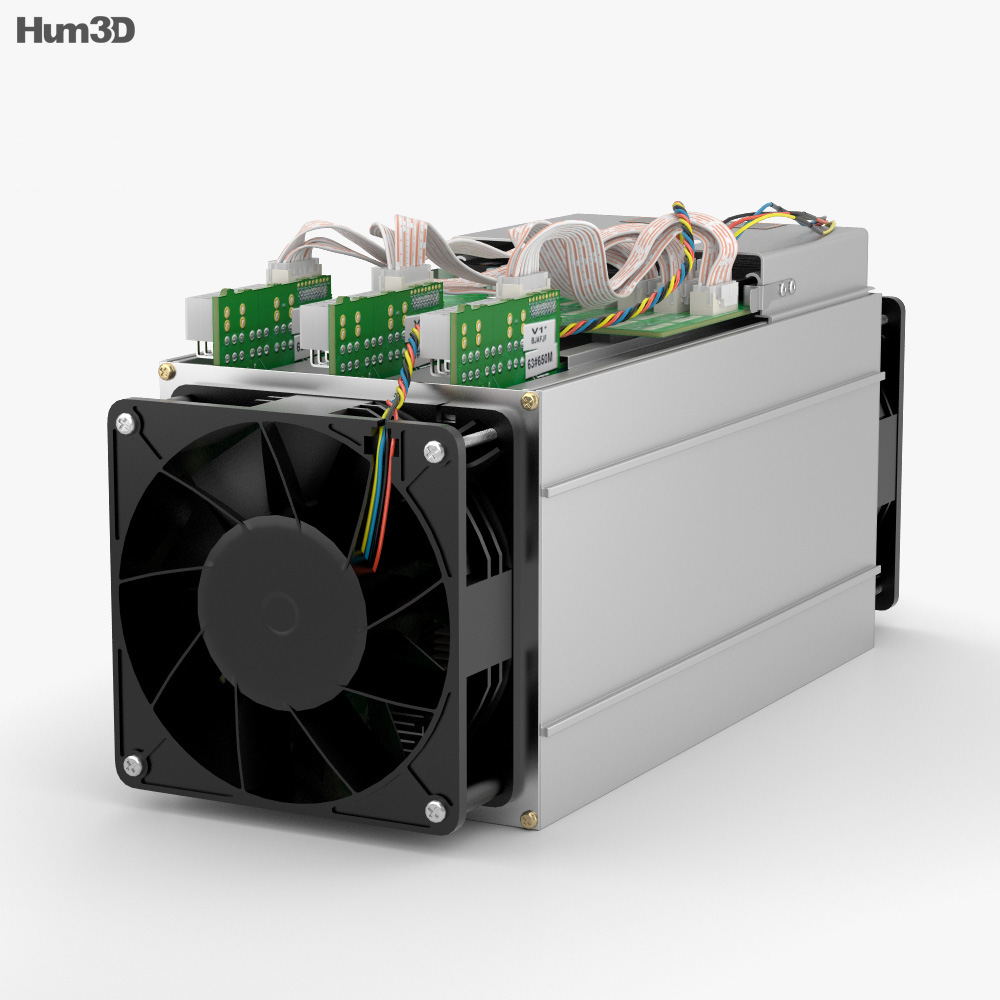

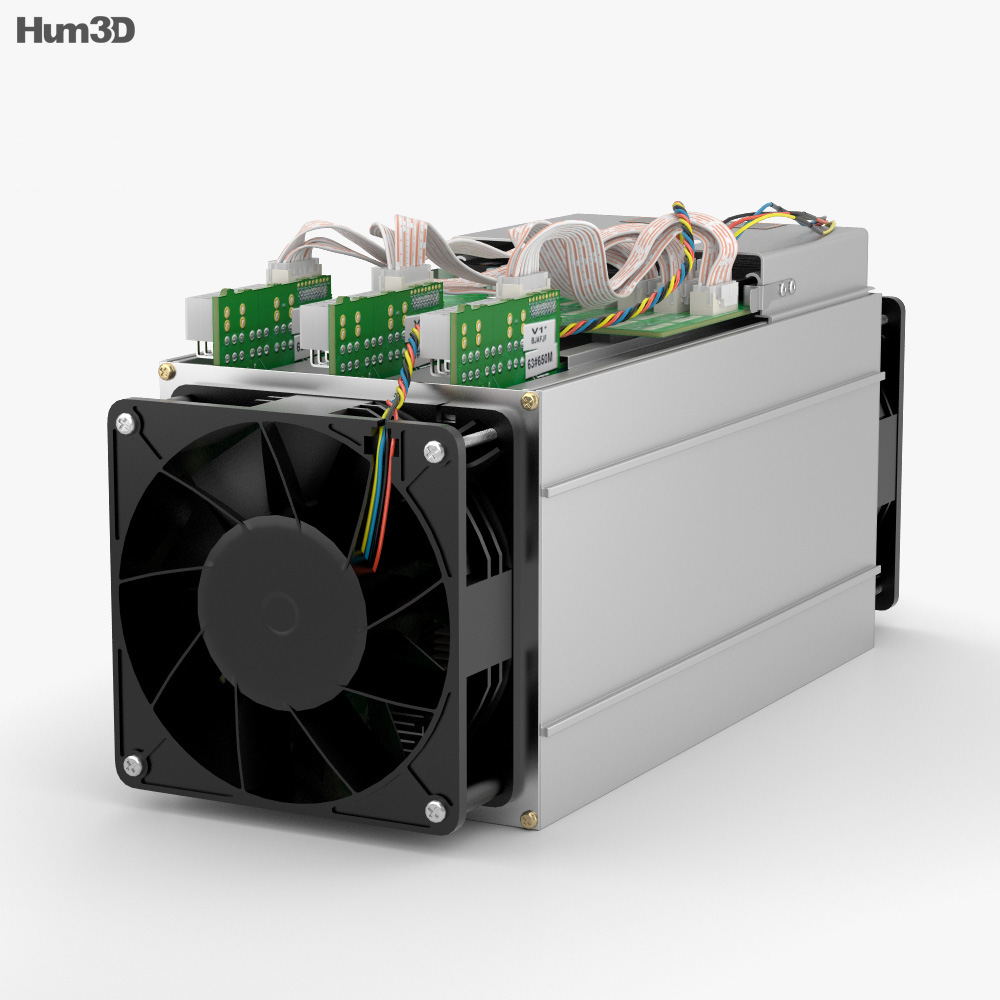

As part of a mining pool, you’ll work with a group of other miners who pool their resources to increase their chances of mining new blocks. These pools generally have minimum hardware requirements, consisting of an ASIC or GPU mining rig.

Best cryptocurrency

An altcoin is any cryptocurrency that is not Bitcoin. The word “altcoin” is short for “alternative coin”, and is commonly used by cryptocurrency investors and traders to refer to all coins other than Bitcoin. Thousands of altcoins have been created so far following Bitcoin’s launch in 2009.

Generally, cryptocurrency price data will be more reliable for the most popular cryptocurrencies. Cryptocurrencies such as Bitcoin and Ethereum enjoy high levels of liquidity and trade at similar rates regardless of which specific cryptocurrency exchange you’re looking at. A liquid market has many participants and a lot of trading volume – in practice, this means that your trades will execute quickly and at a predictable price. In an illiquid market, you might have to wait for a while before someone is willing to take the other side of your trade, and the price could even be affected significantly by your order.

The native token of the Solana platform is called SOL, and is used for paying transaction fees, staking, and participating in governance decisions on the network. The ICO price for SOL was $US0.22, and as of September 24, 2024, now sits at $US146, an increase of 66,263%.

Rae Hartley Beck first started writing about personal finance in 2011 with a regular column in her college newspaper as a staff writer. Since then she has become a leader in the Financial Independence, Retire Early (FIRE) movement and has over 300 bylines in prominent publications including Money, Bankrate and Investopedia on all things personal finance. A former award-winning claims specialist with the Social Security Administration, Rae continues to share her expert insider knowledge with Forbes Advisor readers.

Binance Coin (BNB) is a form of cryptocurrency that you can use to trade and pay fees on Binance, one of the largest crypto exchanges in the world. Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or Bitcoin.

Cryptocurrency reddit

Step 2: Start small and easy. Passive investing in the ‘blue chip’ coins like BTC and ETH are good to go. This is also called DCA (dollar-cost averaging) and because of the volatility of crypto, you either average up or down. $50-100/month is a great start here! You can also diversify your portfolio in other investments like ETFs, bonds and the like. You can continue to allocate more once you have a higher earning power. Can be more, it is subjective to one’s life at the moment (I have house renovation payments coming up).

By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising.

To conclude, it is important to note I am not a financial advisor and this is how I approach my investment in crypto! Please remember to DYOR as always, especially on DeFi protocols because they can get really confusing on the terms, fees and the steps involved!

Step 3: Once you have built up your passive investment portfolio, you can look at active investing. It is crucial to have the first 2 points mentioned above so that you do not crash and burn. Again, start small, allocate maximum 10% of what you are willing to risk into active investing. You can start looking into ICOs, new coins and even crypto interest earning platforms to earn yield on your crypto. For diversification sake, look into CeFi solutions like interest-earning platforms like Hodlnaut, Nexo, Celsius, Anchor Protocol, YouHodler Avalanche. Or owning a masternode by staking 32 ETH. You can even look into doing leverage trading with your crypto. These are all middle to high-risk options and you must be willing to lose them in case shit hits the fan. My strategy is to save up for 6 months, and take for e.g, 5k worth to invest with BTC in let’s say into an interest-earning platform and watch as it does its thing while earning interest! It doesn’t matter if I lose this because I already built a foundation in step 1 and 2!